What is Fractional Ownership Vacation Property?

Fractional ownership vacation property enables multiple buyers to own a legal share in a luxury house, condo, or villa. Each owner has equitable deeded rights, scheduled personal use, and shares in maintenance and expenses. This model offers access to high-end real estate without the full financial burden or property management headaches.

Top Fractional Ownership Vacation Property Markets

Fractional ownership vacation property is booming in top destinations worldwide:

US Destinations:

- Napa Valley, California

- Miami, Florida

- Aspen, Colorado

- Lake Tahoe, California/Nevada

- Park City, Utah

- Maui, Hawaii

- Hamptons, New York

International Destinations:

- French Riviera, France

- Tuscany, Italy

- Cabo San Lucas, Mexico

- Algarve, Portugal

- London, United Kingdom

- Barbados, Caribbean

Vacancy rates in these regions can exceed 80% for traditional second homes. Fractional vacation property platforms report occupancy rates above 70% for shared luxury homes.

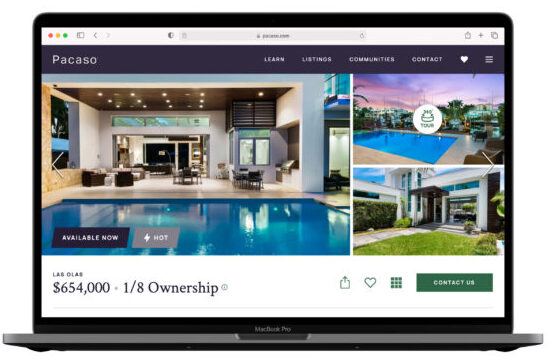

Everything You Need to Know About Pacaso

Pacaso is a leading provider of fractional ownership vacation properties worldwide. Founded by former Zillow executives, Pacaso purchases luxury homes, then divides ownership into eight equal shares. Each owner receives deeded rights, professionally managed property usage, and hassle-free scheduling via Pacaso’s mobile platform.

Key Pacaso features:

- Deeded co-ownership via LLC

- Maximum 44 nights of usage per 1/8 share

- App-based scheduling

- Turnkey property management and cleaning

- Resalable shares after 12 months

- Operates in 40+ premium US and international markets

Big Beautiful Bill: SALT Deduction and Mortgage Interest Changes

SALT Deduction

- State & Local Tax (SALT) Deduction: Raised to $40,000 per tax filer from $10,000 for tax years 2025–2029. Provides greater federal deduction for high-tax markets and fractional ownership vacation property shareowners.

Big Beautiful Bill

- Introduces permanent $750,000 mortgage interest deduction limits for new loans on primary and fractional ownership vacation property.

- The old cap was $1,000,000; the new rule is $750,000, split for married filers.

- Private mortgage insurance is now deductible.

- Energy Property Credits (solar, green tech): Expires Dec. 31, 2025.

Pros and Cons of Fractional Ownership Vacation Property

Pros

- Direct ownership in luxury properties for a fraction of the cost

- Professional management and maintenance

- Higher average occupancy—low vacancy

- Resalable, appreciating equity

- Deductions for mortgage interest and property taxes (pro rata)

Cons

- Limited use per year based on share

- Scheduling requires coordination among owners during peak seasons

- Financing for fractional ownership vacation property shares can be challenging

- Tax benefits are prorated; depreciation applies only for rental use

- The resale market may be less liquid than the whole ownership market

Tax Benefits for Fractional Ownership Vacation Property Owners

| Benefit | Description | Fractional Owners |

|---|---|---|

| Mortgage Interest Deduction | Up to $750,000 home debt; split by ownership share | Yes (pro rata) |

| SALT Deduction (Property Tax) | Up to $40,000 total, split by ownership share (2025-2029) | Yes (pro rata) |

| Depreciation / Expense Deduction | Only qualifies for rental usage; not personal use | No (unless rented) |

| Energy Credits | Solar/energy upgrades eligible until Dec. 31, 2025 | Yes (until expiration) |

Want to explore the tax benefits of a short-term rental? Read here.

Who Should Consider Fractional Ownership Vacation Property?

Fractional ownership vacation property is best for:

- Luxury buyers seeking prestigious access with lower costs

- Busy families wanting furnished, managed second homes

- International buyers looking to diversify their portfolio

- Investors who prioritize use over rental income and seek tax advantages

- Owners unable to maximize high-value real estate alone

Want To Invest In Pacaso Before A Vacation Property?

Investing in Pacaso pre-IPO offers a unique opportunity to participate in the rapid growth of the fractional ownership vacation property market before the company goes public. As an investor, you gain early access to a business that’s redefining luxury real estate, expanding to top U.S. and international destinations.

With global demand for flexible, managed second homes steadily rising, pre-IPO investment in Pacaso positions you at the forefront of real estate transformation, allowing you to capture value in an evolving asset class with significant upside as the company scales and approaches a public offering.

Fractional ownership of a vacation property is the key to unlocking global luxury at an attainable price, with critical new federal tax benefits. With companies like Pacaso leading the charge in premier destinations, buyers get both convenience and expert property management. If maximizing flexible use, occupancy, and strategic tax deductions is your priority, now is the time to explore fractional ownership vacation property options.

Ready to own your dream vacation home? Contact our team to discover top listings and navigate new tax advantages for 2025.

Jonathan Klunk is a licensed real estate agent in Louisville, KY, with EXP Realty, as of this writing. This content is for informational purposes only and should not be considered legal or financial advice. Always consult a qualified real estate, legal, or financial professional before making decisions.