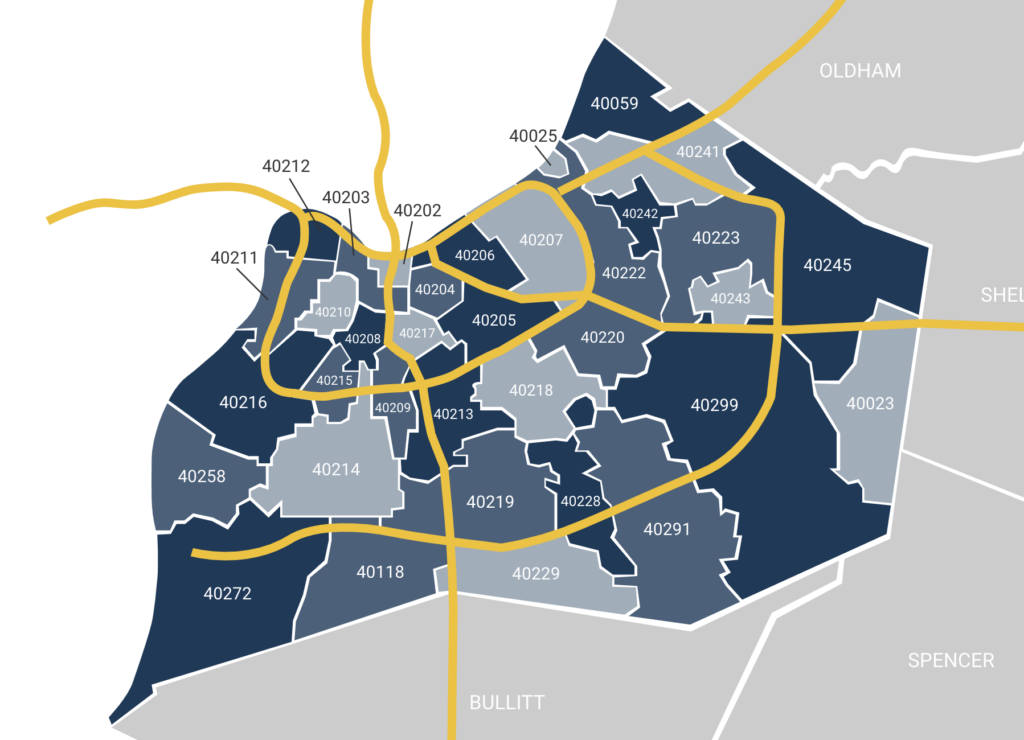

Attention Louisville investors and property enthusiasts! Are you poised to elevate your investment portfolio in the thriving Louisville, Kentucky, real estate market? It’s time to delve into the transformative strategy of owner financing, a hidden gem in real estate investment. This innovative approach is a game-changer, particularly in the vibrant and diverse Louisville property market. Whether you’re a seasoned investor or a budding entrepreneur, understanding the nuances of owner financing can open a treasure trove of opportunities in both the residential and commercial realms of the Louisville real estate landscape. Join us as we navigate this path, shedding light on how owner financing can revolutionize your investment strategy in the heart of Kentucky.

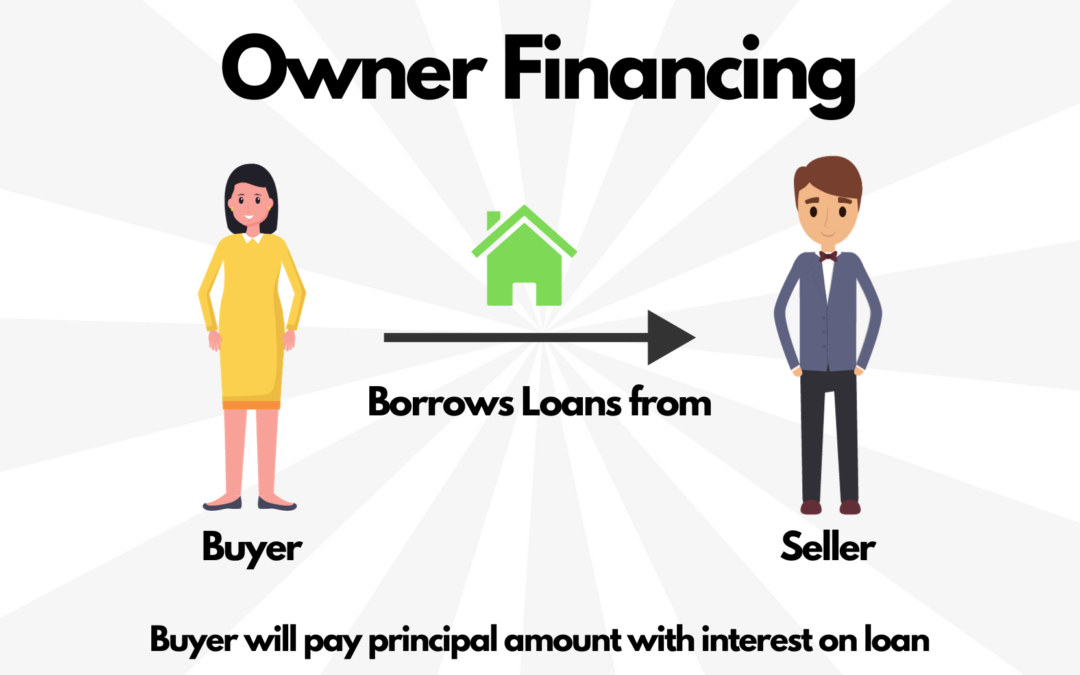

What is Owner Financing?

Owner financing, or seller financing, is a strategic approach in real estate transactions gaining traction in the Louisville, Kentucky market. In this arrangement, the seller steps into the role of the lender, effectively providing a mortgage to the buyer. This alternative financing option bypasses traditional bank loans, offering a more direct and often more flexible route to property ownership.

In Louisville’s dynamic real estate landscape, owner financing presents several unique advantages. This method is particularly advantageous when traditional bank financing is challenging or unattainable. For instance, buyers who may not meet stringent bank requirements due to credit issues or self-employment can still secure a property. Moreover, in Louisville’s competitive market, where quick action can be crucial, owner financing can expedite the purchasing process significantly, avoiding the lengthy timelines associated with bank approvals.

Additionally, owner financing can be a boon for sellers in Louisville. It opens the Property to a broader pool of potential buyers, increasing the likelihood of a sale. Furthermore, sellers can receive a steady income stream through mortgage payments and may command a higher interest rate than traditional savings avenues, making it a potentially lucrative arrangement.

This method also allows for negotiation and customization of terms, allowing both parties to reach a mutually beneficial agreement. Terms like down payment, interest rate, and repayment schedule can be tailored to suit the buyer’s and seller’s specific needs and capabilities. This flexibility is particularly appealing in the Louisville market, known for its diverse range of properties, from historic homes in Old Louisville to modern developments in the East End.

Benefits of Owner Financing in Louisville’s Real Estate Market

1. Enhanced Flexibility in Terms: Owner financing stands out in its ability to offer highly customizable terms. This flexibility extends beyond the interest rate and repayment period, including the down payment amount, amortization schedule, and balloon payments. This flexibility allows for tailored deals that fit each Property’s unique character and value.

2. Expedited Closing Process: The transaction speed is one of the most significant owner financing advantages. Without the need to navigate the time-consuming process of securing a mortgage from a bank, transactions can be completed in a fraction of the time. This is particularly beneficial in hotspots like St. Matthews or Middletown, where properties can move quickly, and buyers must act quickly to secure their desired investment.

3. Significant Reduction in Closing Costs: The absence of traditional lending institutions in owner-financed deals can lead to substantial savings on closing costs. Buyers in Louisville can avoid loan origination fees, processing fees, and administrative costs typically associated with a mortgage. This cost-effectiveness can make investment properties in areas like Crescent Hill or Clifton more accessible.

4. Opportunities for Non-Traditional Buyers: Louisville’s real estate market and buyers are diverse. Owner financing is invaluable for those who might not fit the conventional lending mold. This includes self-employed individuals, those with irregular incomes, or those rebuilding credit. Owner financing thus democratizes property investment in Louisville, allowing a broader spectrum of investors to participate in and benefit from the city’s real estate growth.

5. Potential for Better Returns for Sellers: For sellers in Louisville, owner financing can often lead to a higher overall return on their investment. It is more lucrative since they can negotiate a higher interest rate than what might be earned through traditional banking investments. This can translate to significant financial gains, especially in areas like NuLu or the East Market District, where property values appreciate.

6. Strengthening Buyer-Seller Relationships: Owner financing can foster a more collaborative relationship between buyer and seller. This partnership approach can be efficient in Louisville, where personal connections and local understanding play a key role in successful real estate transactions.

Owner financing offers many benefits that are particularly suited to the diverse and dynamic nature of the Louisville real estate market. From financial savings to increased accessibility for various buyers, this approach is an innovative way to navigate property investment in one of Kentucky’s most vibrant cities.

Ideal Situations for Owner Financing in Louisville’s Real Estate Market

1. Residential Rehab Properties: Louisville is dotted with neighborhoods featuring properties ripe for renovation, from the Victorian homes in Old Louisville to the bungalows in Germantown. Owner financing is particularly well-suited for these “fixer-upper” properties, where traditional financing can be a hurdle due to the Property’s condition. Investors looking to refurbish and flip houses or convert them into rental properties will find owner financing helpful, allowing them to bypass stringent bank requirements that often don’t favor rehab projects.

2. Commercial Ventures: Louisville’s bustling commercial scene, from the burgeoning East Market District to the established business hubs Downtown, offers ample opportunities for small businesses and startups. These entities might have a limited financial history required for traditional loans. Owner financing in such scenarios allows for more accessible entry into commercial real estate, providing a flexible pathway for businesses to acquire storefronts, offices, or warehouses. It can also be a boon for local entrepreneurs looking to tap into Louisville’s growing economy.

3. Land Deals: As Louisville continues to expand, investing in land can be a strategic move. Owner financing is particularly advantageous in land acquisitions, where traditional loans can be more challenging to secure due to the lack of physical collateral in the form of a building. This method opens up opportunities for developing raw land in up-and-coming areas or securing parcels for future development. Owner financing offers a viable path for securing valuable land assets in and around Louisville, whether for agricultural use, residential development, or commercial projects.

4. Multi-Family Dwellings: In neighborhoods like the Highlands or Lyndon, multi-family properties, such as duplexes or small apartment buildings, are excellent candidates for owner financing. These properties can be attractive for investors looking to generate rental income. Owner financing can facilitate the acquisition of these properties, especially for investors who plan to occupy one of the units while renting out others.

5. Unique or Non-Conforming Properties: Louisville also has its share of unique or non-conforming properties that might not fit the typical criteria for bank financing. These could include mixed-use buildings, historic properties, or unusual architecture. Owner financing provides a pathway for investors interested in these distinctive properties to purchase when traditional financing routes are not feasible.

6. First-Time Investors: Owner financing can be an entry point for those new to the Louisville real estate market. It allows first-time investors to start building their portfolios without the daunting prospect of navigating the traditional lending landscape. This can be particularly appealing in a city like Louisville, where the real estate market offers diverse investment opportunities.

Owner financing in Louisville is a versatile tool that can be applied in various scenarios, from residential rehabs to commercial ventures and land deals. Its flexibility and accessibility make it a valuable strategy for a wide range of investors and properties, contributing to the vibrancy and growth of Louisville’s real estate market.

Insights on Structuring an Owner Financing Deal in Louisville

1. Agreeing on a Purchase Price: The first step in structuring an owner-financed deal in Louisville is to agree upon a fair purchase price. This requires a thorough analysis of the current Louisville real estate market, considering factors like neighborhood trends, recent sales of comparable properties, and the specific features and conditions of the Property in question. Whether it’s the growing neighborhoods of Fern Creek or the established areas like St. Matthews, understanding the local market dynamics is crucial. It’s beneficial for both parties to conduct or review an appraisal to ensure a fair and realistic valuation.

2. Negotiating the Down Payment: Typically, down payments in owner-financed deals are higher than in traditional mortgages. This serves as a security measure for the seller and a commitment demonstration from the buyer. In Louisville’s diverse market, the down payment can vary significantly based on property type and location. It’s essential to negotiate a down payment that is substantial enough to protect the seller’s interests while still being achievable for the buyer. This deal aspect can be particularly crucial in higher investment areas like the East End or more affordable regions like Shively.

3. Deciding on Interest Rates: Setting a competitive yet reasonable interest rate is a balancing act. The rate should reflect the current market conditions in Louisville and align with what would be expected in a conventional mortgage. Yet, it should also account for the increased risk the seller is taking by not requiring traditional financing. Both parties might consider the average rates in Kentucky and adjust based on the deal’s specifics, such as the buyer’s creditworthiness and the Property’s location and condition.

4. Setting the Loan Term: The loan term in an owner financing deal should reflect a balance between the buyer’s ability to pay and the seller’s desire for a return on investment. Shorter terms can lead to higher monthly payments but quicker returns for the seller, whereas longer terms can make payments more manageable for the buyer but delay the seller’s total return. In Louisville, where the real estate market can vary from fast-growing areas to more stable, mature neighborhoods, selecting the correct term length is crucial for both parties’ financial planning.

5. Ensuring Legal Compliance: Adherence to all Kentucky real estate laws is non-negotiable. This includes drafting a legally binding purchase agreement that outlines the deal’s terms, such as the repayment schedule, default consequences, and any clauses specific to the Property or deal. Consulting with a Louisville-based real estate attorney is highly recommended to ensure the contract is comprehensive and compliant with all state and local regulations. This legal oversight is vital to protect both parties and to ensure a smooth, legally sound transaction.

By carefully considering these aspects, parties in a Louisville owner-financing deal can structure a beneficial and equitable agreement for both the buyer and the seller. It’s a collaborative process that requires clear communication, a good understanding of the local market, and due diligence to ensure a successful real estate transaction in Louisville’s dynamic market.

Expanded Strategies for Negotiating Owner Financing in Louisville

1. Understanding Seller Motivations: The key to any successful negotiation in owner financing is understanding the Seller’s motivation. In Louisville’s real estate market, sellers might opt for owner financing for various reasons: a desire for a steady income stream, challenges in selling the Property traditionally, tax benefits, or even personal reasons like a commitment to supporting community development. Understanding these motivations can provide valuable leverage in negotiations. For instance, if a seller is interested in a quick sale due to relocation, a buyer might negotiate a lower purchase price in exchange for a faster closing. It’s essential to have open and honest discussions to uncover these motivations, which can vary widely in Louisville neighborhoods, from the rapidly developing South End to the more established areas like The Highlands.

2. Presenting Your Financials: Demonstrating a solid financial background is crucial in owner financing negotiations. Sellers in Louisville will be more inclined to consider owner financing if the buyer can show stability and reliability in their financial history. This includes providing proof of income, a healthy credit score, and evidence of financial responsibility. It’s beneficial for buyers to prepare a comprehensive financial portfolio, including tax returns, bank statements, and any other documents that can attest to their financial health. This not only instills confidence in the seller but also aids in securing favorable terms for both parties.

3. Discussing Future Plans for the Property: Sellers in Louisville may be more receptive to owner financing if they know their Property will be used in a way that aligns with their values or visions. This is particularly true in areas with strong community ties or specific development goals, like the revitalization areas in West Louisville or the historic preservation districts. Buyers should openly share their intentions, whether renovating a residential property, launching a local business, or developing a commercial space. This can create a sense of partnership and trust, potentially leading to more favorable terms in the owner financing agreement.

4. Getting Professional Help: Navigating owner financing in Louisville’s diverse real estate market can be complex. Seeking professional assistance from a real estate expert who understands the nuances of Louisville’s neighborhoods, market trends, and legal requirements is invaluable. A local real estate agent or attorney can provide insights into market-specific practices, help draft a fair agreement, and address all legalities. They can also assist in negotiations, bringing experience and expertise to help both parties reach a mutually beneficial arrangement.

By considering these expanded strategies, parties involved in owner financing in Louisville can approach negotiations with a more informed perspective, leading to prosperous and equitable agreements. Understanding the seller’s motivations, presenting strong financial credentials, sharing plans for the Property, and seeking professional guidance are critical steps in navigating the complexities of owner financing in the vibrant and varied Louisville real estate market.

Final Thought on Owner Financing

In essence, owner financing is more than just a financial arrangement; it’s a strategic tool that can open doors to many real estate ventures in Louisville. Its ability to adapt to different scenarios, save on costs, and cater to a wide range of properties makes it an invaluable strategy for anyone looking to tap into the potential of Louisville’s real estate market. Whether you’re a seasoned investor or a first-time buyer, exploring the possibilities of owner financing could be the key to achieving your real estate goals in one of Kentucky’s most dynamic cities.

Ready to Explore Owner Financing in Louisville? Whether you’re eyeing residential, commercial, or land investments, owner financing could be your key to success. Need guidance? Reach out to Six Degrees Real Estate, where we specialize in making your Louisville investment dreams a reality. Let’s discuss how we can make owner financing work for you in Louisville!